Early Close a Running Trade

Why do need a trade close early?

Basically, the best-analyzed trade closes by reaching Take profit or stop loss. But sometimes due to a change in market structure, Smart money traders need to close a trade earlier. In this article, we put it clearly in detail. Some common factors are as follows-

1. Lack of Liquidity

Firstly, Liquidity is the main key factor that moves the market. If the market is running with a shortage of liquidity there needs to close the trade. The concept of liquidity refers to the ease with which an asset can be bought or sold in the market without affecting its price. In forex markets, liquidity is a crucial factor that determines the efficiency and stability of the market. When there is sufficient liquidity, buyers and sellers can easily find each other and execute transactions without significant price movements. However, if there is a shortage of liquidity, it can lead to market inefficiencies, such as wider bid-ask spreads, increased volatility, and slower trade execution. In such situations, traders may need to close their positions to avoid losses or take advantage of opportunities in other markets with better liquidity. Therefore, understanding the level and dynamics of liquidity is essential for successful trading and investing in financial markets.

2. Fundamental News

Any big fundamental events like NFP, FOMC, or Any central Bank events, like the rate decision of the Bank of England we trade cautiously. during significant events such as Non-Farm Payroll (NFP), Federal Open Market Committee (FOMC), or central bank events like the rate decision of the Bank of England. The speaker mentions that they trade cautiously during these events, likely due to the volatility and unpredictability that can occur. It is common for traders to adjust their strategies or positions during significant events to minimize risk and take advantage of potential opportunities.

3. Weekend Market Low Volatility

It is risky to keep the interday set up over the weekend. In this case at the end of the trading week need to close all open positions. The text is warning about the potential risks of keeping an interday trading setup (a trading strategy that involves opening and closing positions within the same day) open over the weekend. The author suggests that it is better to close all open positions at the end of the trading week to avoid any unexpected market movements or events that could result in losses. This advice is particularly relevant for traders who do not have the capacity or willingness to monitor their positions over the weekend. It is important for traders to assess their risk tolerance and make informed decisions about their trading strategies based on their individual circumstances and market conditions.

Manual Close or Early Close

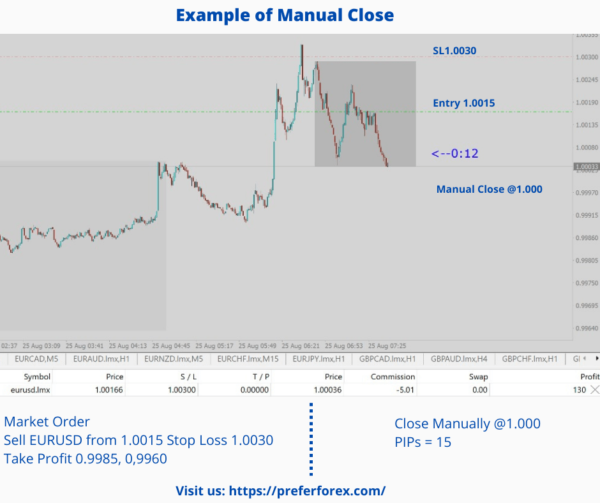

A trade may need to close early before going to the target this is said manually closed. During trading sometimes we need to close early a profitable or losing trade if we find any special key level or lack of liquidity to move to reach the target. Here we close 100% of the lot. Sometimes we find such a trade. This is the example we sell entry the pair EURUSD @1.0015 it moves straight down to our target. But here some of the research shows it may not go down now and we close the trade at @1.000. Here is the details chart example in the chart.

Today’s Forex Signal was –

Sell EURUSD from 1.0015 Stop Loss 1.0030

Take Profit 0.9985, 0,9960

Trade update message – Close the trade now at 1.000 with +15Pips,

In this above trade, our entry was in 1.0015, and the stop loss was 15 pips at 1.0030 Our first target was 30 pips at 0.9985 which as usual a 1:2 risk-reward for the 1st target. But the trade straight moving the target with zero draws most trade looks like this because of our institutional prices level analysis. Anyway, the trade stuck at the important level of 1.000 and our research team decided to close and send trade updates on WhatsApp and email accordingly.

Profit potentiality in this trade –

We close the trade at 15 PIPs

For the Standard lot here you can make 10×15 = $150. Here no partial close so full profit is booked.

That is how early close or manual close works.

How do we make more profit from this technique?

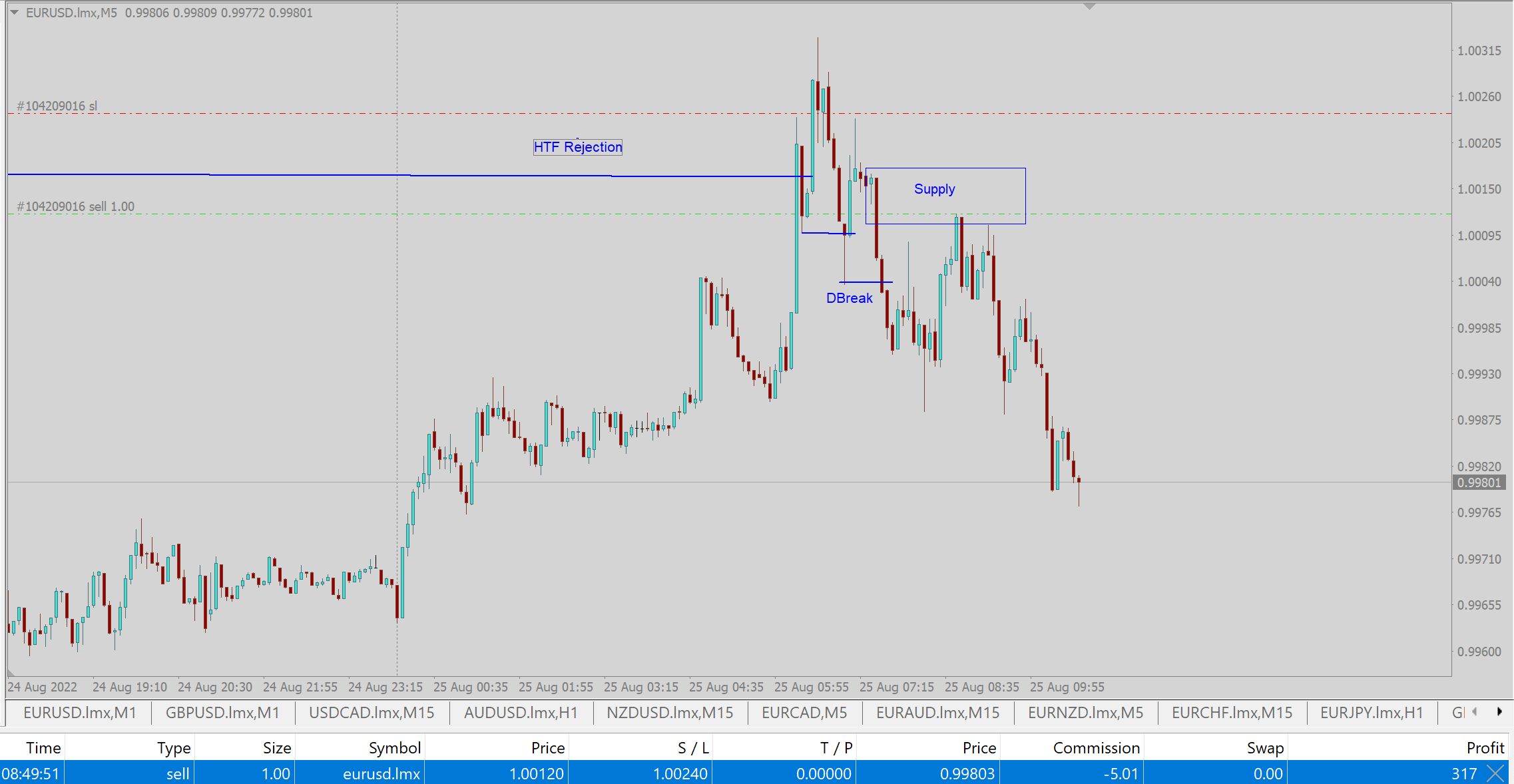

Our trader panel knows that the market can back to the level again and observe the trade. So they monitor the pair and as soon as the price is back to the expected level and find the base for trade they send and sell signals and give a very good profit.

Again we send signals on the same pair EURSD as follows –

Sell Limit EURUSD from 1.0012 Stop Loss 1.0024

Take Profit 0.9980, 0.9955

Result – 2nd Target Hit

This was a pending order The trade hit entry and without a single pip draw down it reached the first target and second target.

Profit factor in this trade –

Stop Loss = 18 PIPs

Fist Target = 32 PIPs

Second Target = 57 PIPs

Most of our trade goes to Target without a single pip drawdown. We manage trade very well which ultimately gives a good return.

Our team of analysts may decide to close a signal early if certain factors require it. This closure message will be sent to WhatsApp, indicating that the signal was closed manually and at what price it was closed. This information is important for tracking the performance of the signal and understanding the reasoning behind the early exit. The team of analysts will carefully consider all factors before making the decision to close a signal early, as it can have an impact on overall profitability.

Using The Forex Signal Services

It is effortless to utilize a forex trading signal service as there are numerous paid & free forex signals accessible in the market. All you have to do is sign up and follow the instructions provided on the site. However, it is essential to note that there are various signal services available in the market, and they differ significantly in terms of signal quality and risk tolerance. Therefore, before choosing any forex signal service, you should gather all the necessary information about the service provider and then decide which one is the best fit for you. Most importantly look into risk vs. reward to make consistent profit. For a better understanding of risk high reward signals see our trades on Facebook here facebook.com/PreferForex

In this video you can see how our forex trading signals work to make a consistent profit it is just one-week signals. Hope to see you as a profitable trader with us.