Spike in Forex Chart

Why create a Spike in Chart & How to detect a false or real spike

What is the spike in the forex chart?

The sudden large movement in the Forex market due to an imbalance of liquidity is called a spike. We can see such spikes most of the time on major data releases such as Non-Farm Payroll (NFP), FOMC statements, ECB Press conferences, Rate declarations, etc. We can also see such a spike in normal market conditions without news due to banks’ large orders. Basically, the forex market draws a price bar that looks like the trading activity went crazy in this period. In this article, we shall discuss all the points of abnormal behavior in price.

In a Forex chart a spike produces the following features:

- A meaningful price gap – In the forex chart gap is the difference between the opening and closing levels of the previous day. Mostly, the gap is forming because the close and open of the previous day/ time frame are at different price levels. In markets with high volatility, gaps can also occur within a session.

- A sharp price rebound – In forex or stock trading price rebounds are a natural occurrence within the constantly changing price behavior. That means the price moving to the opposite side from previous big moves.

To understand this topic first you need to know about Liquidity because liquidity is the main mover of the market. Below we write details of liquidity activities and how they influence the forex chart to make a spike.

What is Liquidity?

The Liquidity is the estimate of the trading activity in the forex market. Liquidity is a measure of how easily an asset can be exchanged. Liquidity is an economic term that designates the amount of money immediately available. Thus, when we talk about liquidity, we tend to designate the assets, in cash. Market liquidity depends on the asset concerned, but within the same asset class, there are also different levels of liquidity. Infect, for the liquidity forex market moves in a certain direction. So to understand order flow a trader must know about liquidity. This is liable for creating price action and a spike in the chart.

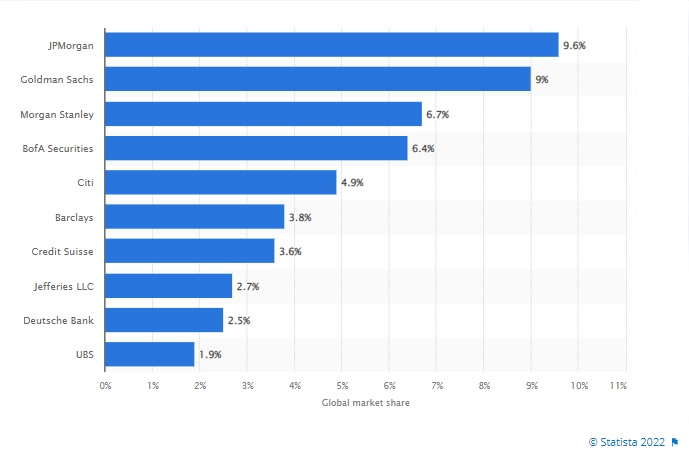

For Example, Major banks, hedge funds, Investment Firms, and other largest financial institutions maintained forex liquidity in the marketplace. Liquidity providers such as commercial banks connect brokerages with those institutions. This way they fill the order books with an unlimited amount of bids and ask-offers.

Liquidity risk

One of the main risks linked to investment is liquidity risk. It is an inherent risk in investing. It refers to the fact of not being able to sell its assets m at a price far below their intrinsic value. This fall in prices in order to conclude a sale on an illiquid market is called an illiquidity discount.

To create a spike in the forex chart Liquidity is very much relative. Forex Spike Trading is a popular trading style for some traders. I am here going to describe the financial, and technical causes behind the creation spikes on the chart. To build up Spike Trading Strategy you need to know the real cause of Spike.

In this view two main reasons are behind:

Excessive liquidity

Lack of liquidity

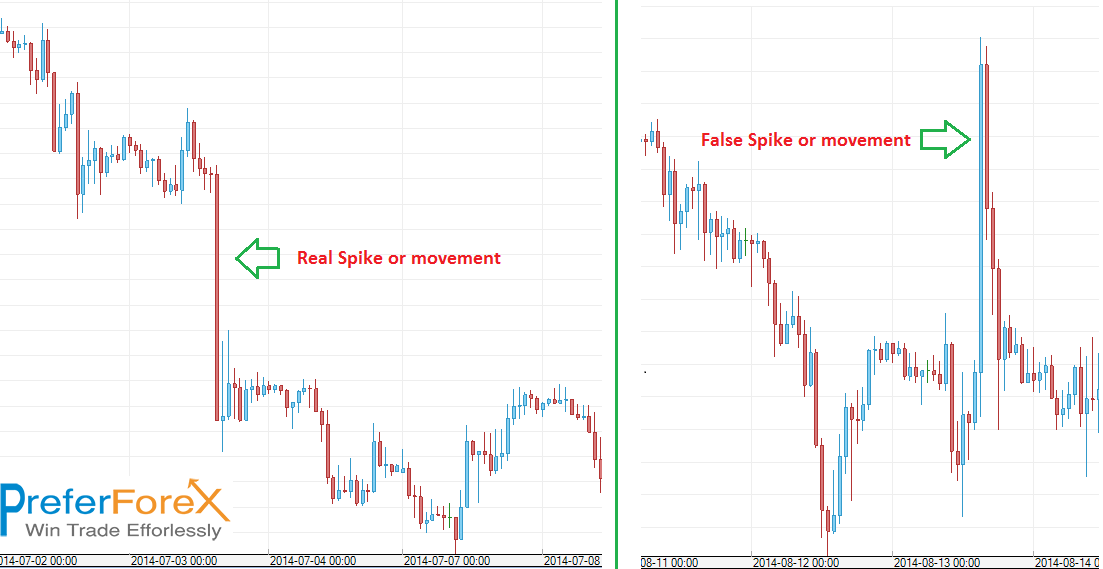

As a trader, you are already familiar with also 2 types of spikes we can see in the market: a. False spike b. Real spike. I have stated here those types to make it easy to understand the topics.

Excessive Liquidity

Firstly, Excessive liquidity and illiquidity in banking are situations of concern for the monetary authorities of a country. Excessive liquidity leads to a Real spike in the market. When there is excessive liquidity market spikes and make a fresh movement. The market does not have any news or fundamental issues for this movement. Most of you may be surprised by seeing this movement without any news. But the truth is that when there is excessive liquidity market moves crazily and this leads to a fresh movement. This excessive liquidity performs in the market because Professional money, Big investor, or banks take their position. This movement can occur at any time with or without any news.

Here to examples of spikes in the chart

Lack of Liquidity

A lack of liquidity leads to a False spike in the market. Illiquidity raises fears of bank panics, which can lead to rushes on deposits, sometimes leading to banking crises. In forex trading, we refer to the market liquidity as closely linked to that of the liquidity of a financial asset. This refers to the speed with which this asset can be exchanged for money without loss of value. Liquidity is the main mover of the market. Lack of liquidity, a currency pair activity would be chaotic, with price jumps, and gaps in the chart. Illiquidity can cause abnormal price swings and unmanageable fluctuations.

Fundamental & Illiquidity

Moreover, fundamental aspects can make fewer bid-ask offers in the market. Illiquidity occurs mostly at the time of the news. During news time or 1/ 2 minutes before the news, the market moves crazily in a direction, then returns immediately to the level from where it starts the movement by making a false spike. This is because if there is a lack of liquidity market moves crazily up or down to collect the liquidity. But it can’t sustain and return to the level from where the price starts to move. When markets make such a false spike to collect liquidity the interbank cannot shift the exchange rate and they still trade with the previous price level, for this reason, the market returns to the previous price by creating a false spike.

On the above side, it is shown that the left side chart creates a nice spike in the downside and after the market stays the price level. This is the real spike movement. But on the other hand right side, the up buy spike corrected immediately.

In conclusion, a trader must use the proper trading opportunity of trading all the time. Hope this article helps you next time when you find a spike in your terminal. PreferForex traded all cautiously all the market situation upon best analysis and market information that is unique forex signals provider.