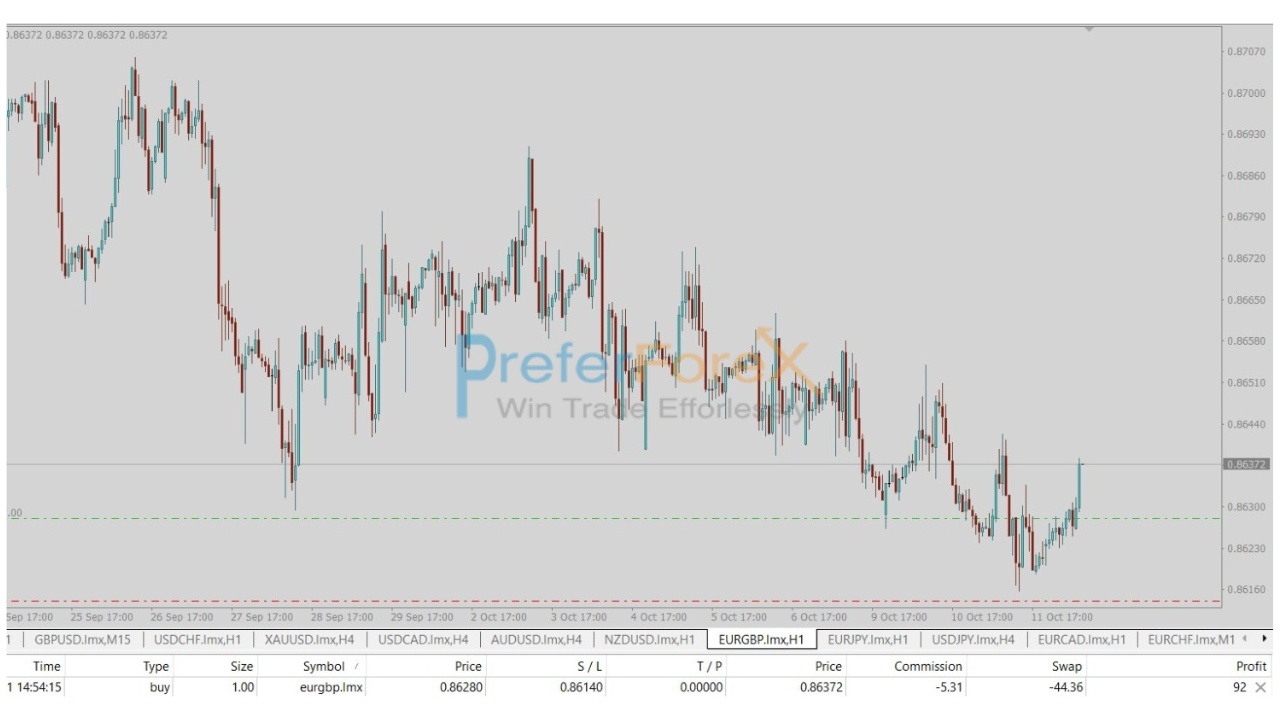

EURGBP Technical Overview today

There is a minor resistance at 0.8654, which remains intact. As a result, further decline is expected with a target support level at 0.8568. The recent rebound from 0.8491 might have been completed after being rejected by the 0.8700 resistance level. If 0.8568 is broken, a retest of the 0.8491 low could be seen. However, if the price surpasses the minor resistance at 0.8654, the intraday bias will turn neutral.

Looking at the bigger picture, the current downtrend from the 2022 high of 0.9267 is considered part of a long-term range pattern that started from the 2020 high of 0.9499. A decisive break above the 0.8700 resistance level would suggest that the decline has been completed with a three-wave pattern down to 0.8491. In that case, the rise from 0.8491 would represent another leg within the pattern, with potential targets at 0.8977 and higher. However, if the price is rejected by the 0.8700 level, it would indicate that the downtrend is still in play and could lead to another decline below 0.8491 in the future.

We have sent signals to the premium members last day

EUR/GBP. This pair has displayed bearish signals, but it’s currently facing resistance, indicating a possible upward correction. Our trading signals on the EURJPY pair the trade is already in profit –

Upward Correction Potential

The presence of resistance suggests that the EUR/GBP pair may be primed for an upward correction. Corrections are commonplace in the Forex market and can present opportunities for traders, both short-term and long-term. There are several reasons why we might anticipate an upward correction:

- Oversold Conditions: The prolonged bearish sentiment may have driven the pair into oversold conditions, triggering profit-taking and a subsequent upward movement.

- Economic Data Releases: Upcoming economic data releases, including employment figures and GDP growth, can sway market sentiment, leading to short-term corrections.

- Geopolitical Developments: Political or economic events, such as trade negotiations or policy changes, can have a significant impact on currency pairs, resulting in corrections.

Find our September trading Performance Here

The EUR/GBP pair has recently exhibited bearish but has found resistance from 0.8620 hinting at a potential upward correction in the near future. Traders and investors should stay vigilant, monitoring economic events, central bank policies, and technical indicators as they make informed trading decisions.

It’s essential to remember that the Forex market is highly speculative and carries inherent risks. Practicing effective risk management strategies and seeking expert advice are paramount for those engaging in trading. The EUR/GBP pair’s movements can change swiftly, so staying informed and adaptable is key to success in this dynamic market.

.

Get our forex signals FREE trial. We mainly focus on Risk to reward which is a minimum of 2:1 to 8:1 with every trade See some following trades of October -2023