Forex Long-Term Trading Signals

A Discussion on Long-Term, Short-Term, and Mid-Term Forex Trading

Long Term Forex Trading Strategy – Make Big Profits!

Key Points

- Various Types of Strategy

- Long Term Trading

- Position Trading

- Swing Trading

- Best Long Term trading

- Short Term Forex Trading

- Example of Medium Long Term Trading

Types of Forex Trading Strategies:

A variety of forex trading strategies is being used by forex traders globally to identify the best entry and exit price and find out the best time of trading. To understand the currency movement market analysts, and traders are making, and updating trading strategies continuously.

Market analysts and traders are constantly innovating and improving upon strategies to devise new analytical methods for understanding currency market movements. What follow are some of the more basic categories and major types of strategies developed that traders often employ.

All those strategies can be classified into 2 types. Those are –

- Long Term Forex Trading Strategy.

- Short Term Strategy.

Newbie forex traders are required to develop a strategy that adopts your best. Let’s look at the easiest ones that can be used even for those who are starting now in the world of Forex Trading. Some time needs to combine multiple strategies to get better output.

Forex Long Term Trading

For forming a long-term trading signal, a trader needs to deal with larger insight into the price action. Usually such trade rollover the night that does not close during the trading day. This trading is in the big picture infect we feel it is safe trading. For this kind, trade needs well analysis. To operate in the medium and long term, it is necessary to have sufficient capital available, which may allow you to maintain the positions for a long. This is why this strategy is reserved for investors with greater purchasing power. Long trade infects for big profit but not be with market play every day. Some Traders believe that long-term trade is a billionaire trader zone.

From PreferForex YOUTUBE

Macro-Economic View Needs To Consider

Economists and policymakers make a prediction forecast about the country’s economy through the help of the macro-economy.

The macro view is most important for a long-term position, Observing the development of the national economy of the concerned currency is also important to enter a long-term position. Macroeconomy data are like employment, interest rates, CPI, and even politics. Those data publish in the pre-determined schedule in an economic colander. To trade in the big picture, you need to know the fundamentals related to the currencies.

Probability of Long Trem Forex Trading

Making a long-term trading strategy involves some analytics work. Two types of long term trading strategy used by experienced traders. Long-term forex traders do not have to worry about stop hunting produced by intraday spikes as they use wide stop loss margins that make their positions safe from daily market volatility.

2 Popular Long Term Trading

a. Position Trading

b. Swing Trading

Position Trading –

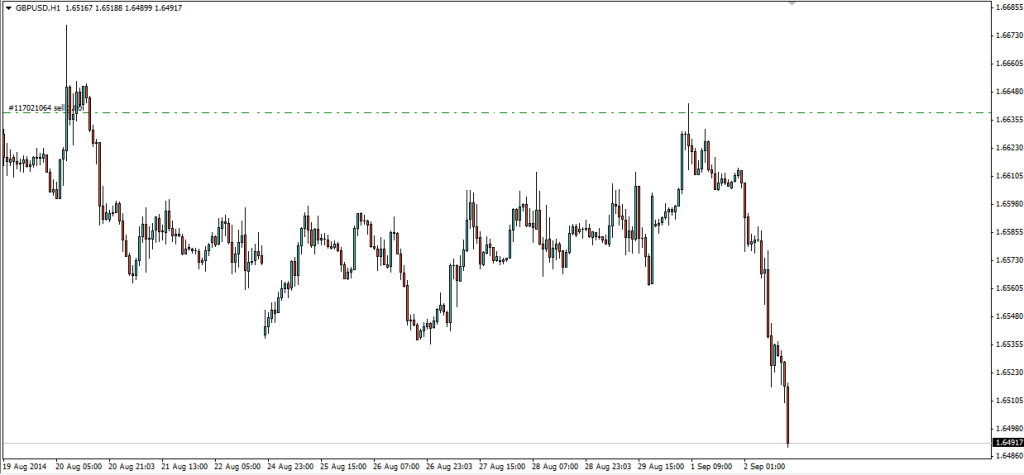

Position trader observes a higher time frame chart on a weekly or monthly basis to get the best forex signal from the market.

A position trader is aware of the fundamental view of market movement and determines from the macroeconomic aspect where to enter. A usual position trade can hold their trade for a week to months or years.

Position Trader Trade very few trades yearly that make a significant outcome. Position trader doesn’t look after short term market movement.

Technical Analysis and the market trend are followed by a swing trader to get the expected entry and exit. Position trader holds a position for a few days or weeks. They don’t depend on fundamental analysis.

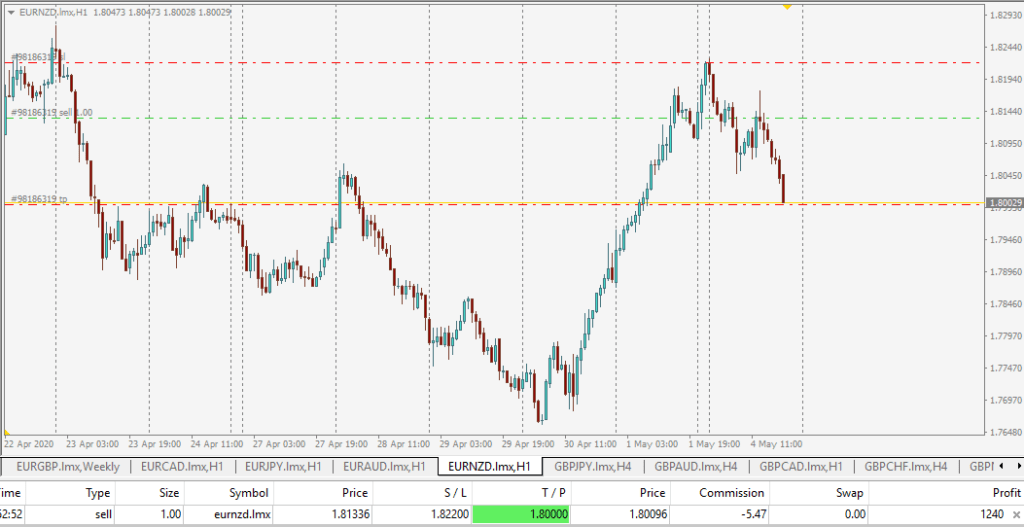

Evaluate The Swap – Long Position

For long term traders, sometimes swaps can reduce your profit. Swap is charged by the broker for holding a position overnight.

Using Leverage – Long Position

A long position can face a certain big drawdown if your account is using high leverage and risk management is not well planned then it could be an issue to go loss. To stay in day-to-day market fluctuations using 10:1 or less leverage will allow a trader to trade risk-free.

However, the results show that long-term trading can generally produce more money. In addition, it allows greater control over risks. On the other hand, too, it is easier for new investors to learn to trade long-term rather than short-term.

Finally, the Long-time frames like weekly and monthly using these time frames, a trader gets a better view and a more complete picture of previous support or resistance level and where could be next move.