GBP / USD Outlook Today NFP Release

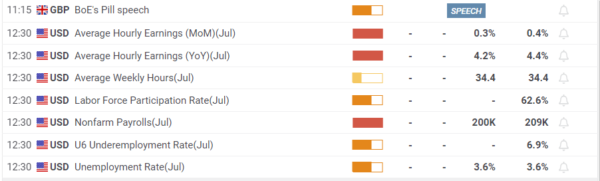

The GBP/USD (British pound/US dollar) currency pair had mixed movements yesterday. The pair fluctuated between the values of 1.2620 and 1.2725, ultimately ending the day with no significant changes. Today, the pair increased slightly and reached a level of 1.2740. However, if there is a sudden increase then the price is followed by a break of the resistance level at 1.2796, it will likely maintain a bullish trend in the short term and shift the bias toward an upward direction. As of August 4, 2023, the GBP/USD currency pair is facing potential volatility due to the release of the Non-Farm Payrolls (NFP) report. The NFP data is a crucial economic indicator released by the U.S. Bureau of Labor Statistics, which measures the number of non-farm jobs added or lost in the United States during the previous month

GBPUSD Price Action

The GBP/USD currency pair has been under the spotlight recently as traders closely monitor its movements. After a period of consolidation, market order flow suggests that the pair may be gearing up for a bullish run from a significant support area, known as the extreme demand zone. In this post, we will look into the reasons behind this potential upward movement, exploring the key factors that could influence GBP/USD’s trajectory and the implications for traders.

The extreme demand zone that we show in the video analysis is a specific area where the price has historically experienced strong buying interest, preventing further downward movement. Traders often consider these zones as potential turning points in the market, as demand typically outweighs supply, leading to upward price movements.

Non-Firm Payroll Impact on GBPUSD

Today is NFP release day, GBP/USD currency pair and its recent movements before NFP, The GBP/USD has been trading above the support level of 1.2700, which has helped it to recover from a four-day losing streak. The Bank of England (BoE) is expected to announce a 25 basis point increase in the policy rate to 5.25%, but the market needs reassurance that the BoE will continue to tighten policy despite easing price pressure. A 50 bps rate increase could provide strength to the Pound Sterling, but it could also signal an end to the tightening cycle. On the other hand, a 25 bps hike combined with a dovish message acknowledging softer inflation and loss of momentum in economic growth could trigger a fresh leg lower in GBP/USD. Cable holds a positive note above 1.2700, snapping a four-day losing streak in early Europe on Friday. Investors digest the dovish BoE outlook amid a modest pullback in the US Dollar, supporting the pair ahead of the critical US NFP release.

Source: fxstreet.com

Today GBP/USD Trading & Risk Management

The initial reaction was in favor of the US dollar due to the Federal Reserve’s hawkish stance, but this has since faded away. Although the markets have largely ignored this data so far, there may be increased price volatility closer to the release of the NFP figure.

While the outlook appears bullish, traders need to exercise prudent risk management. Trading involves inherent risks, and market sentiment can quickly change. To mitigate potential losses, consider the following:

- Set Stop-Loss Orders: Determine a suitable stop-loss level below the extreme demand zone to limit losses in case of an unexpected market reversal.

- Monitor Price Action: Watch for confirmation of the bullish move through price action patterns and candlestick formations. An engulfing bullish pattern or a hammer could signal a potential reversal.

- Keep Abreast of News Events: Stay informed about economic events and political developments that could impact the GBP/USD pair, as sudden news can disrupt technical patterns.

Get our Institutional forex signals FREE trial. With every subscription, we provide a free risk management guide to enhance your trading quality. With every signal we provide clear stop loss and target and depending on price action we send close notifications if required to close early.