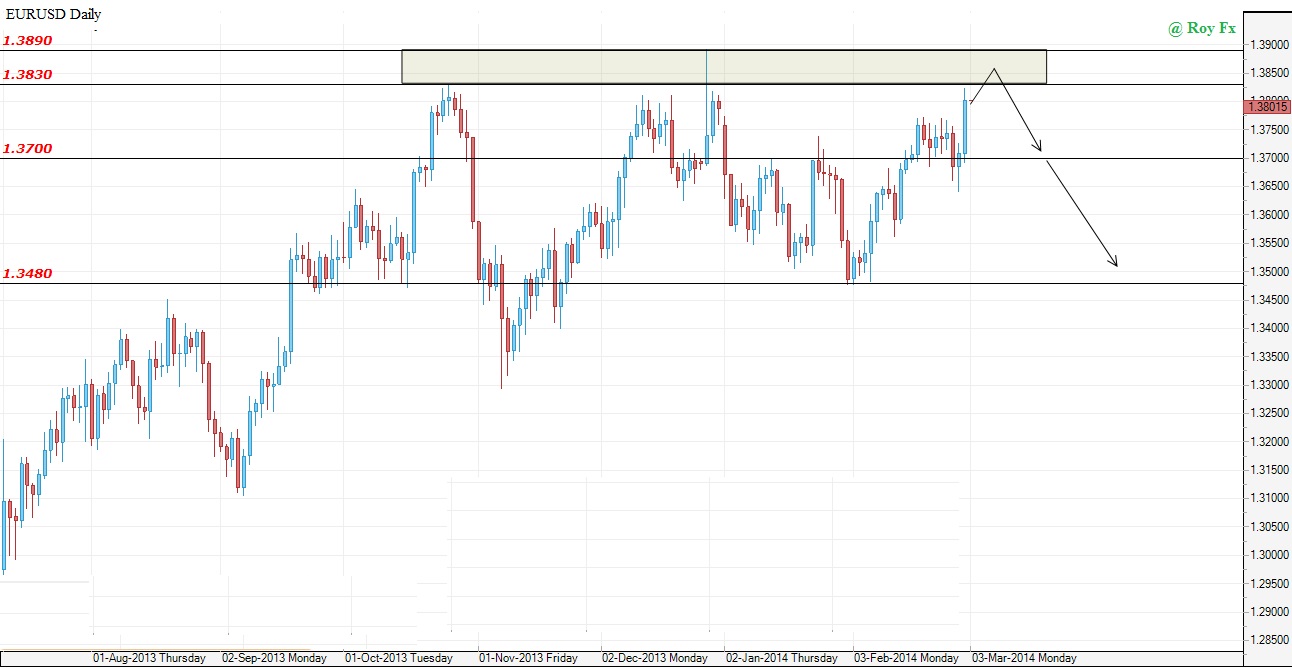

EURUSD USD Technical Outlook: Strong Support Area Analysis

The EURUSD pair is currently approaching a critical support area between 1.3830 and 1.3890, a region that has twice previously repelled downward movements. This historical behavior suggests that we may once again witness a bearish reversal from this zone. However, it is essential to closely monitor price action in this area to confirm any potential reversal signals.

Key Support Zone Analysis (1.3830-1.3890)

Historically, the 1.3830-1.3890 support zone has proven to be a barrier for EURUSD. Each approach to this level has resulted in a significant bounce back, indicating strong buying interest. The market structure within this zone will be important in determining the pair’s next move.

Bearish Scenario: Potential Downside Targets

Should EURUSD respect this support area once more, we anticipate a bearish movement. The first key target on the downside is 1.3700, a psychological level that could provide interim support. Beyond this, the long-term viewpoints to 1.3480 as a further downside target, where historical price activity suggests the next significant support lies.

Bullish Scenario: Invalidating the Bearish Outlook

While the prevailing sentiment leans towards a bearish reversal, we must also consider the alternative. A break and daily close above 1.3900 would invalidate the bearish outlook. Such a move would signal a potential shift in market sentiment, likely leading to further bullish momentum. Traders should be prepared for this scenario, as it would suggest that the support zone has been decisively breached, potentially opening the path to higher levels. Get the Exact Entry, Take profit, and stop joining free Forex signals

Observing Price Action: Confirmation is Key

At this juncture, observing price action is paramount. Reversal signals, such as bullish engulfing patterns, hammer candlesticks, or clear rejection wicks, within the 1.3830-1.3890 zone would strengthen the case for a bearish movement. Conversely, sustained buying pressure and a close above 1.3900 would necessitate a reassessment of our bearish bias.

Conclusion

The EURUSD pair is at a critical juncture near the 1.3830-1.3890 support zone. Historical precedence suggests a bearish reversal is likely, targeting 1.3700 and 1.3480 in the long term. However, a break and close above 1.3900 on the daily chart would invalidate this outlook, signaling a potential shift toward bullish momentum. As always, traders will closely observe price action to confirm their positions and adjust their strategies accordingly.

Stay updated on the latest market movements and adjust your trading plans based on the unfolding price action around this pivotal support area. Get our all analysis on the YouTube Channel