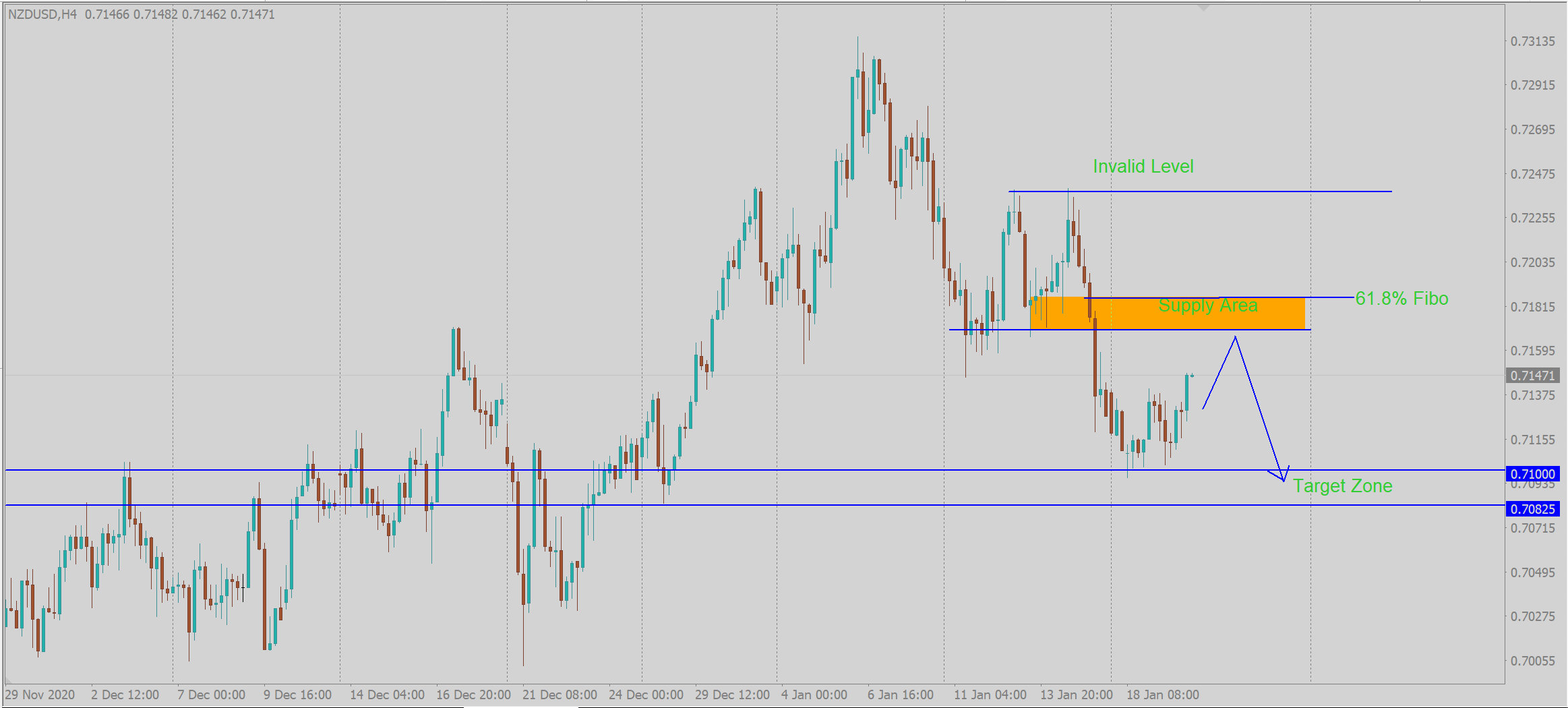

NZDUSD Moving Towards a Supply Area: Trading Recommendation and Detailed Chart Analysis

NZDUSD is moving toward a supply Area, the Trading recommendation is as follows with a details Chart Analysis. It is recommended short position from the supply zone that we mark the below chart at below Fibonacci 61.8%. After reacting to the supply Area, the price can target here at 0.7100 you can see the blue line in the chart. Don’t trade if the price goes to an invalid level The Invalid point of the setup will be 0.7240.

NZDUSD Technical Outlook: Key Levels and Trading Strategy

Current Scenario:

The NZDUSD pair is showing a significant uptrend, nearing a supply zone that has historically acted as a strong resistance area. This supply zone is crucial as it aligns closely with the 61.8% Fibonacci retracement level, making it a potential turning point for the pair.

Key Levels:

– Supply Zone (Entry Point): 0.7180 – 0.7200 (Marked on the chart)

-Target Level: 0.7100 (Indicated by the blue line on the chart)

– Invalidation Point: 0.7240 (Trade should not be taken if price surpasses this level)

Get Forex Signals with Exact Entry Take, Profit and Stop Loss in Your WhatsApp number Join here

Detailed Chart Analysis:

The chart above illustrates the NZDUSD pair approaching the supply zone. The Fibonacci retracement from the recent high to low shows the 61.8% level precisely within this zone, reinforcing its significance.

Trading Recommendation:

Given the technical setup, we recommend considering a short position from the supply zone between 0.7180 and 0.7200. This zone is marked by previous price reactions and aligns with the Fibonacci 61.8% retracement, suggesting a high probability of a price reversal.

Entry: Short position within the supply zone (0.7180 – 0.7200)

Target: Aim for 0.7100, as indicated by the blue line on the chart. This level has previously served as a support and could act as a significant take-profit zone.

Stop-Loss: Set at 0.7240 to manage risk effectively. If the price breaches this level, it invalidates the setup, and the trade should not be taken.

Risk Management:

Trading within the Forex market always carries risks. Ensure you use proper risk management techniques, including setting stop-loss orders and avoiding over-leveraging your positions. The invalidation point at 0.7240 serves as a critical risk management tool, ensuring losses are minimized if the market moves against the expected direction.

Conclusion:

The NZDUSD pair is nearing a significant supply area, presenting a short-selling opportunity within the 0.7180 – 0.7200 range. With the target set at 0.7100 and a strict invalidation point at 0.7240, Hope the analysis help with a well-defined risk-reward ratio.

For a more smart money analysis and updated charts, subscribe to our newsletter and join our community of informed traders. Happy trading!

Visit our Facebook for daily update signals