EURNZD Analysis and Forecast

Key Points:

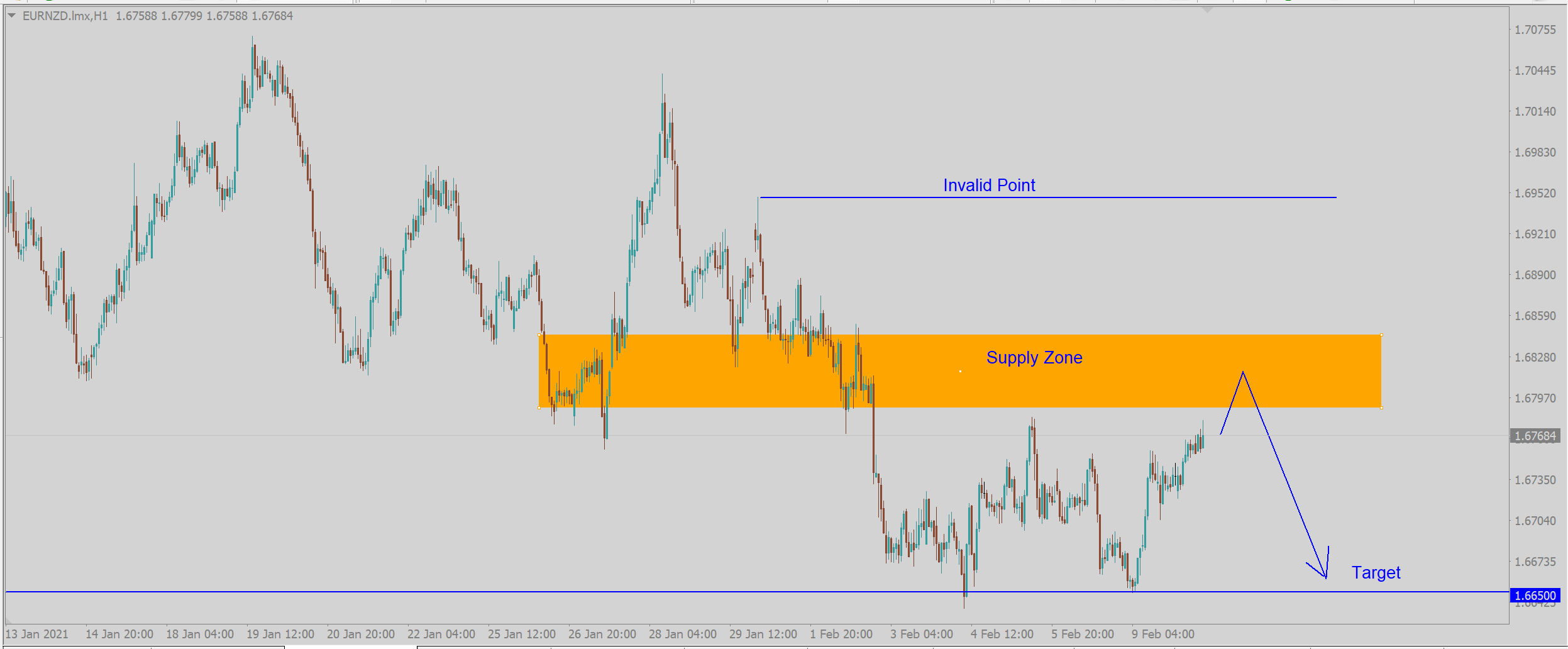

EURNZD is near the supply Zone, Expecting Bearish movement. The trading Recommendation is as follows:

Recommending Short Position from the marked supply Zone with the target of 1.6650

The Recommendation will be invalid at the level of 1.6950

EURNZD, the currency pair representing the Euro against the New Zealand Dollar, is currently positioned near a significant supply zone, suggesting a potential bearish movement in the near future. This analysis prompts a trading recommendation for a short position from the marked supply zone, with a target set at 1.6650. It is important to note that this trading recommendation will become invalid if the price reaches the level of 1.6950.

The technical analysis of EURNZD indicates a crucial point of interest near the supply zone, where sellers are likely to be more active, leading to a possible downward movement in the pair. Traders looking to capitalize on this potential bearish scenario may consider entering a short position from the identified supply zone, aiming for a target price of 1.6650. However, it is essential to closely monitor the price action and be prepared to reassess the trade if the pair approaches the invalidation level of 1.6950.

In the broader context of the forex market, several factors could influence the future direction of EURNZD. Economic data releases from both the Eurozone and New Zealand, as well as geopolitical developments, can impact currency movements. Traders should stay informed about relevant news and events that could affect the exchange rate between the Euro and the New Zealand Dollar.

Furthermore, central bank policies and interest rate decisions can play a significant role in shaping currency trends. The monetary policies of the European Central Bank (ECB) and the Reserve Bank of New Zealand (RBNZ) are crucial factors to consider when forecasting the future movement of EURNZD. Any shifts in policy stance or unexpected announcements from these central banks could lead to volatility in the currency pair.

Risk management is a key aspect of successful trading in the forex market. Traders should always define their risk tolerance, set stop-loss orders to limit potential losses, and adhere to proper position sizing principles. By effectively managing risk, traders can protect their capital and enhance their long-term trading performance.

In conclusion, the analysis of EURNZD suggests a potential bearish outlook near the supply zone, with a trading recommendation for a short position targeting 1.6650. Traders should remain vigilant, closely monitor price movements, and be prepared to adjust their strategy if the price approaches 1.6950. Keeping abreast of market developments and employing sound risk management practices are essential for navigating the dynamic forex market successfully.

1 Comment. Leave new

Target Achieved